Foreign direct investment (FDI) has long been a hallmark of globalization, helping to transform entire firms, cities, sectors, and economies. For evidence of this, we look no further than China.

Attracting cumulative net inflows of $3.5 trillion since 1979 has enabled the country to grow its GDP by almost 8,000%. Over a similar time frame, China has also lifted 700 million citizens out of poverty.

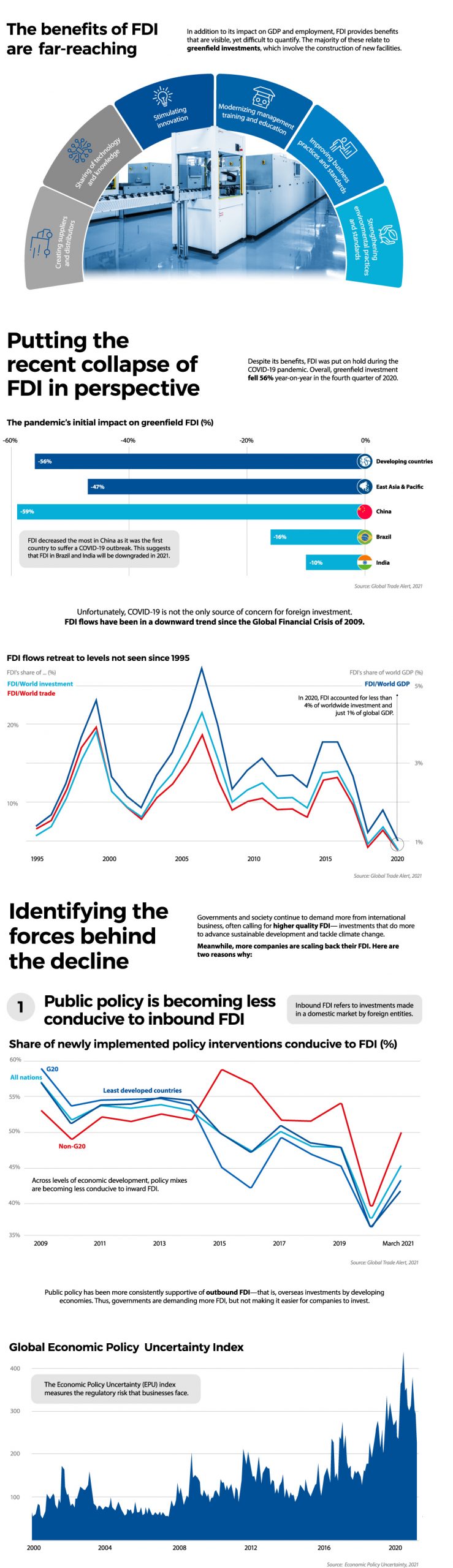

Despite all of the benefits that FDI can deliver, global investment flows have been in a downward trend since the Global Finanicial Crisis of 2009. Our sponsor, the Hinrich Foundation, puts this collapse into perspective.

The Decline of FDI

The COVID-19 pandemic took a heavy toll on FDI in 2020, especially in terms of greenfield investment. These investments involve the construction of new facilities in foreign countries.

| Region or Country | Change in Greenfield FDI* (%) |

|---|---|

| Developing countries | -56% |

| East Asia & Pacific | -47% |

| China | -59% |

| Brazil | -16% |

| India | -10% |

*Year-on-year decrease in the fourth quarter of 2020.

Within developing economies, FDI decreased the most in China as it was the first country to suffer a COVID-19 outbreak. For Brazil and India—two countries which experienced major outbreaks in 2021—FDI is expected to be fall much further.